Strategies of investment

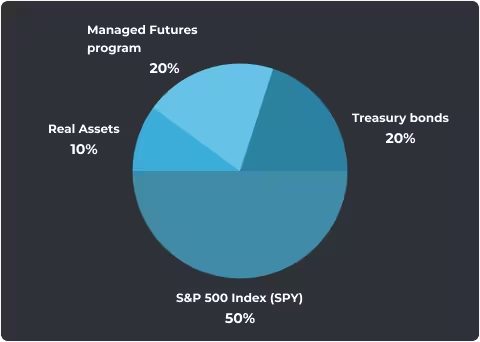

We design diversified portfolios that combine leadership and innovation in the U.S. market through products like ETFs, providing efficient and cost-effective access to top technology and innovation companies. Our strategy includes a foundation of stability with Treasury bonds, corporate bonds, or high-yield bonds, balancing security and returns in a dynamic economic environment.

To safeguard wealth, we incorporate alternative assets such as gold, commodities, and real estate, mitigating inflation risks and preserving long-term value. Each portfolio is optimized with advanced and personalized strategies to ensure a balance between stability, growth, and diversification, tailored to the specific needs of our clients.

We offer exclusive access to a variety of alternative investments, including real estate opportunities in the U.S., Europe, and other global markets. Additionally, we facilitate private credit investments that deliver attractive returns. These opportunities span across industries such as construction, infrastructure, and energy sectors, including oil and gas. Investments are structured through segregated vehicles and tailored commercial financing projects to optimize returns and mitigate risks.

Our proprietary quantitative system, developed and refined over more than five years, leverages Big Data and artificial intelligence to systematically manage risks, diversify portfolios, and deliver market-independent returns. Libra Quant operates continuously to identify key signals in real time, adapting to both bullish and bearish trends to maximize performance in any market condition.